Real Estate Investment Advisory

CREFIC provides a full range of commercial real estate financial modeling and investment advisory services. Our experienced Real Estate Investment Analysts offer expert guidance to help you assess the financial feasibility of your projects and make smart, informed decisions. Whether you’re a developer, lender, or investor, our services are designed to simplify complex CRE transactions and empower you to unlock new opportunities.

- Sources & Uses (S&U)

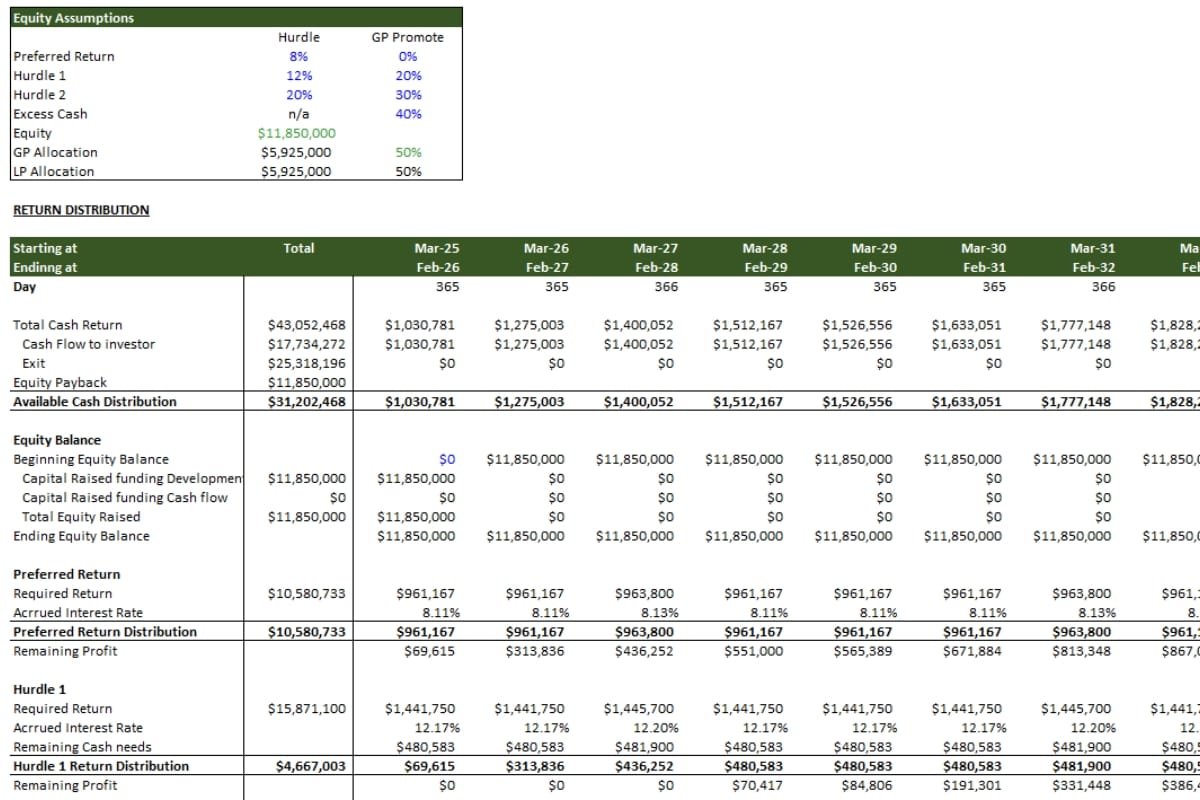

- Equity Waterfall

- Construction Cash Flow Analysis

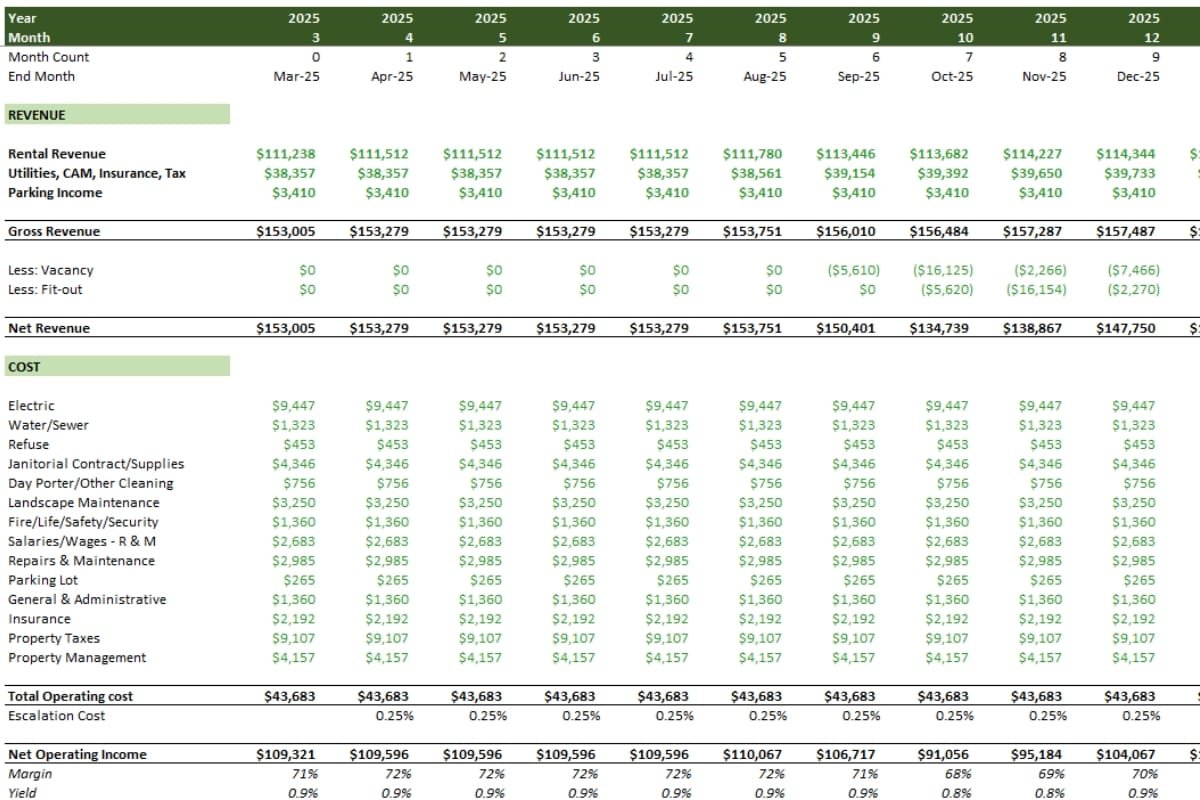

- Operation Cash Flow Analysis

- Tenant Schedule

- Sensitivity Analysis

- Exit Valuation

- Debt Schedule

- Recommended Land Price

- Key Return Metrics

Our Other Services

Step We Take To Analyze The Deal

01

Discovery & Goal Setting

We begin by understanding your investment objectives and gathering all relevant project details, ensuring we have a clear picture of your goals and constraints.

02

Market & Financial Analysis

Next, we conduct thorough research on market conditions, revenue projections, operating expenses, and cap rates to lay a solid foundation for your project’s feasibility.

03

Model Development & Validation

Using the findings, we build a financial model that includes the various functions mentioned above. We then refine and validate it to ensure accuracy and clarity.

04

Advisory & Report

We review the model's outcomes with you and offer strategic advice. Then, we prepare a concise report with key findings and actionable recommendations to guide your next capital market moves.

Frequently Asked Questions

A robust feasibility analysis is crucial because it evaluates a project's financial viability, identifies potential risks, and lays the groundwork for creating an investor-ready pitch deck to secure the necessary capital.

Our model integrates sources and uses, equity waterfall structures, cash flow projections for both construction and operations, sensitivity analysis with cap rate adjustments, a detailed debt schedule, and return metrics like IRR, Equity Multiple, and DSCR.

We combine rigorous market research with thorough data validation, refining our models to reflect current market conditions and realistic assumptions.

Absolutely. Our investor-ready models and strategic insights support you in crafting compelling business plans and pitch decks to attract capital.

Depending on project complexity, initial models are often drafted within 10 days, followed by a detailed review and validation phase.

We discuss the model outcomes with you, provide strategic advisory services, and offer a concise report with key findings and recommendations for your next steps.

We work with a wide range of commercial real estate projects, including multifamily, office, industrial, retail, and mixed-use developments, etc.